FairShare

Overview

What is FairShare?

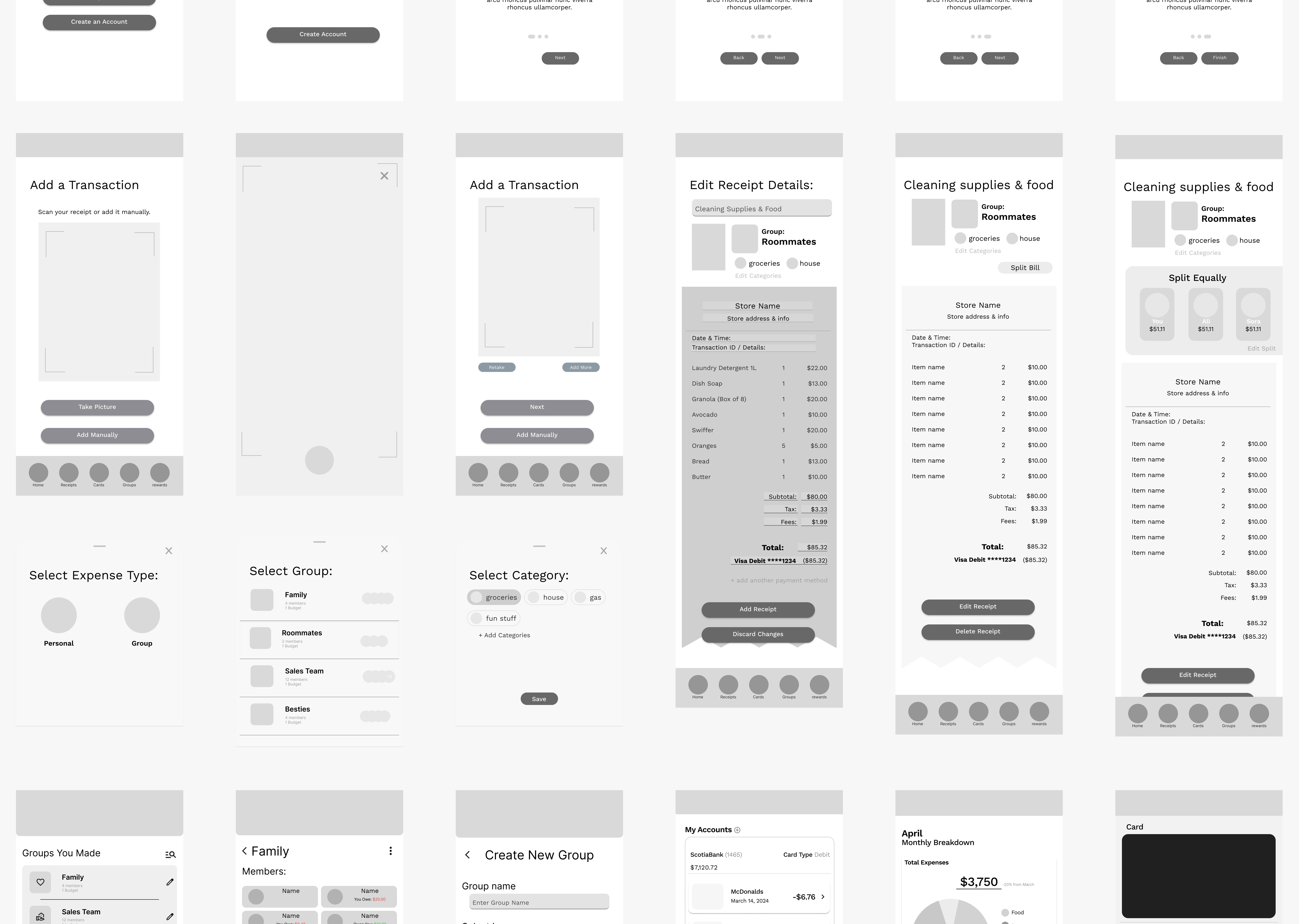

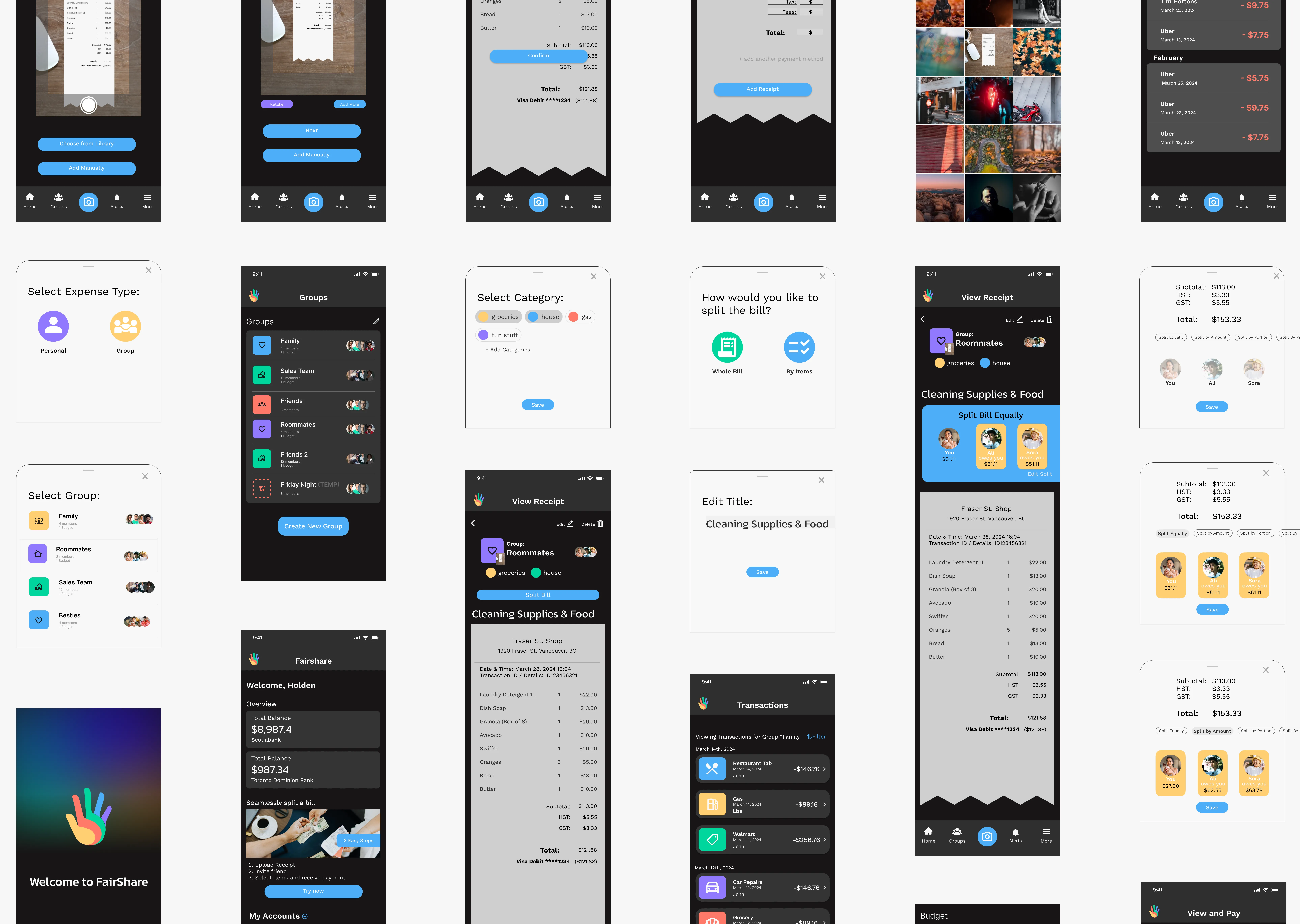

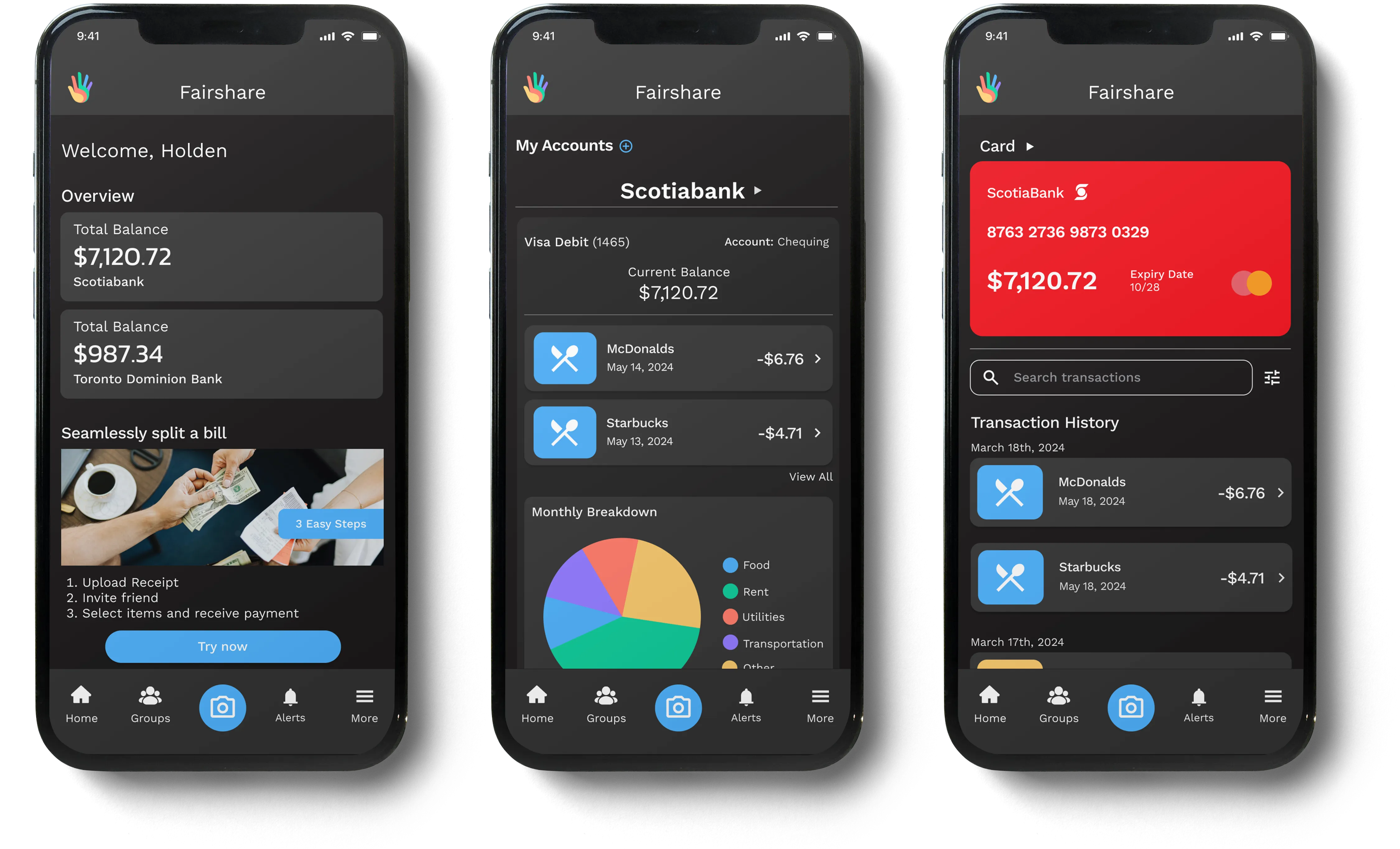

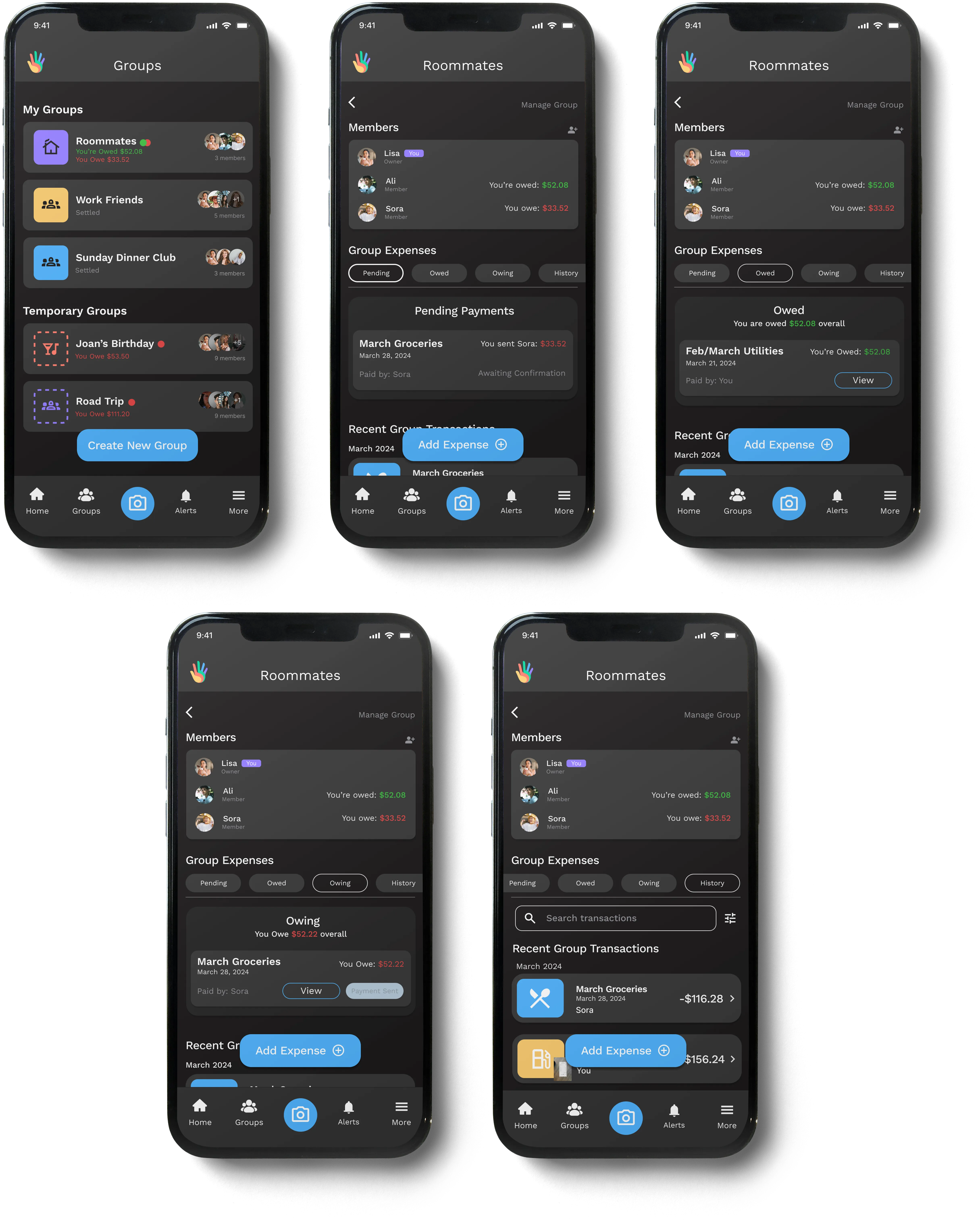

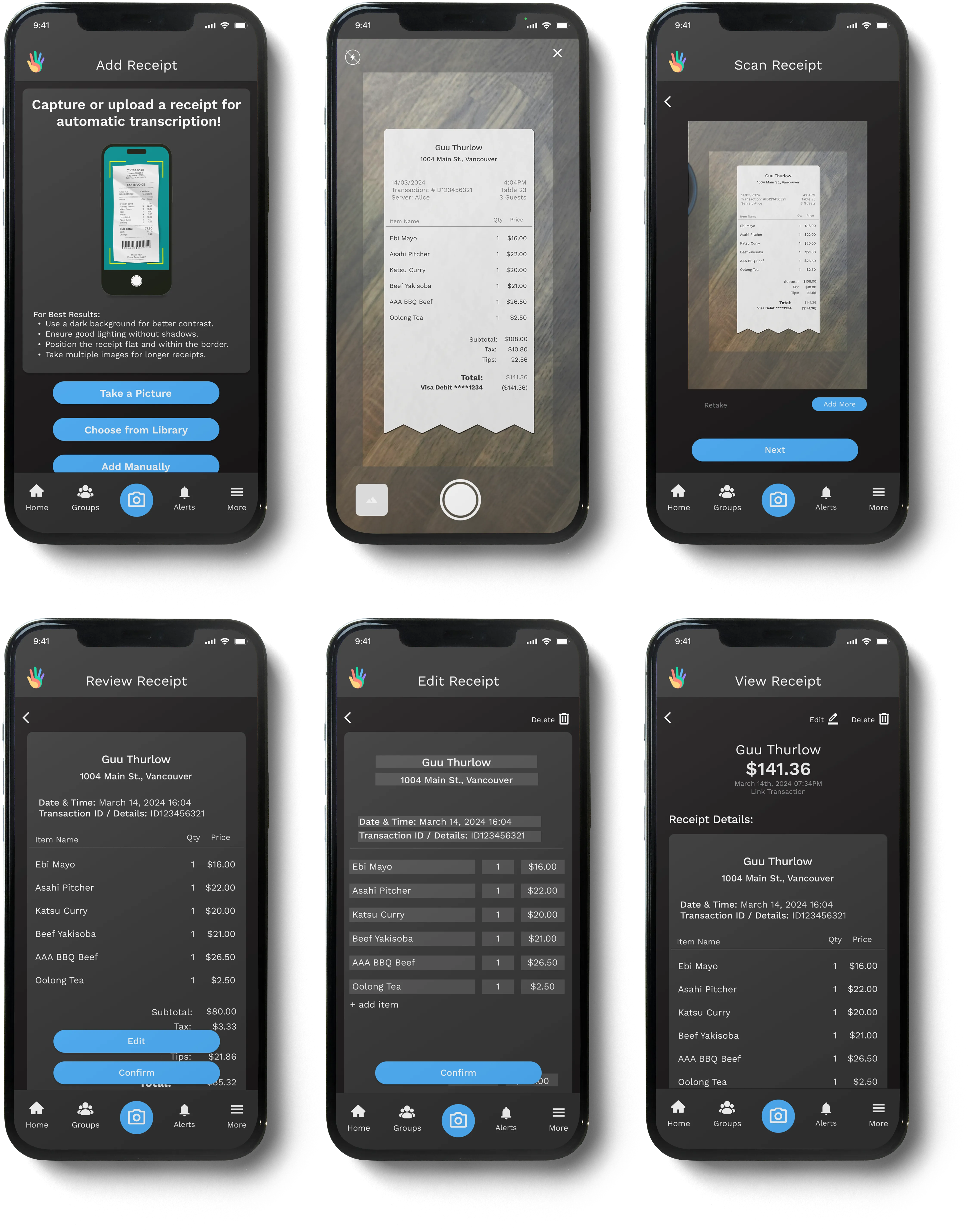

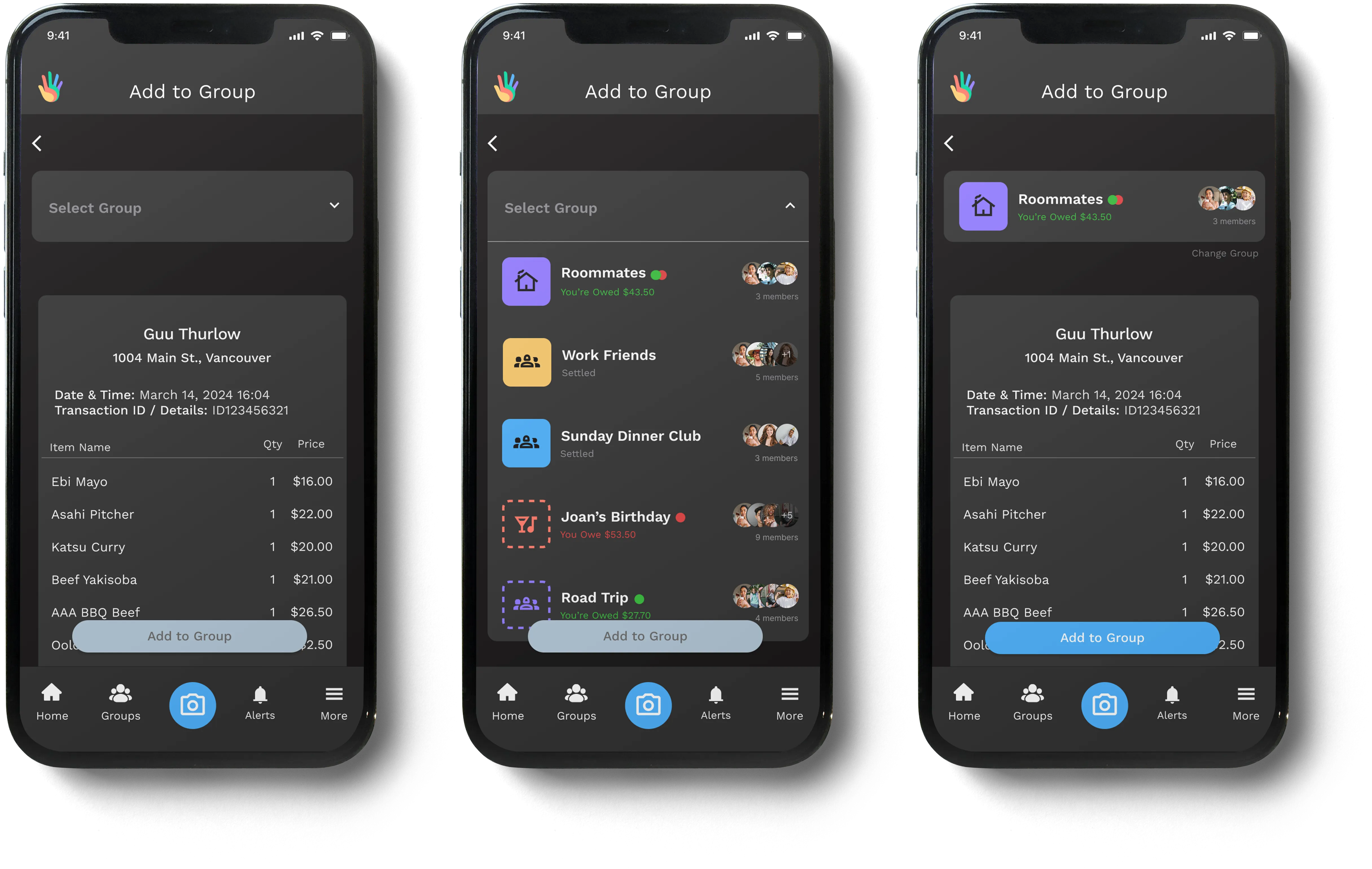

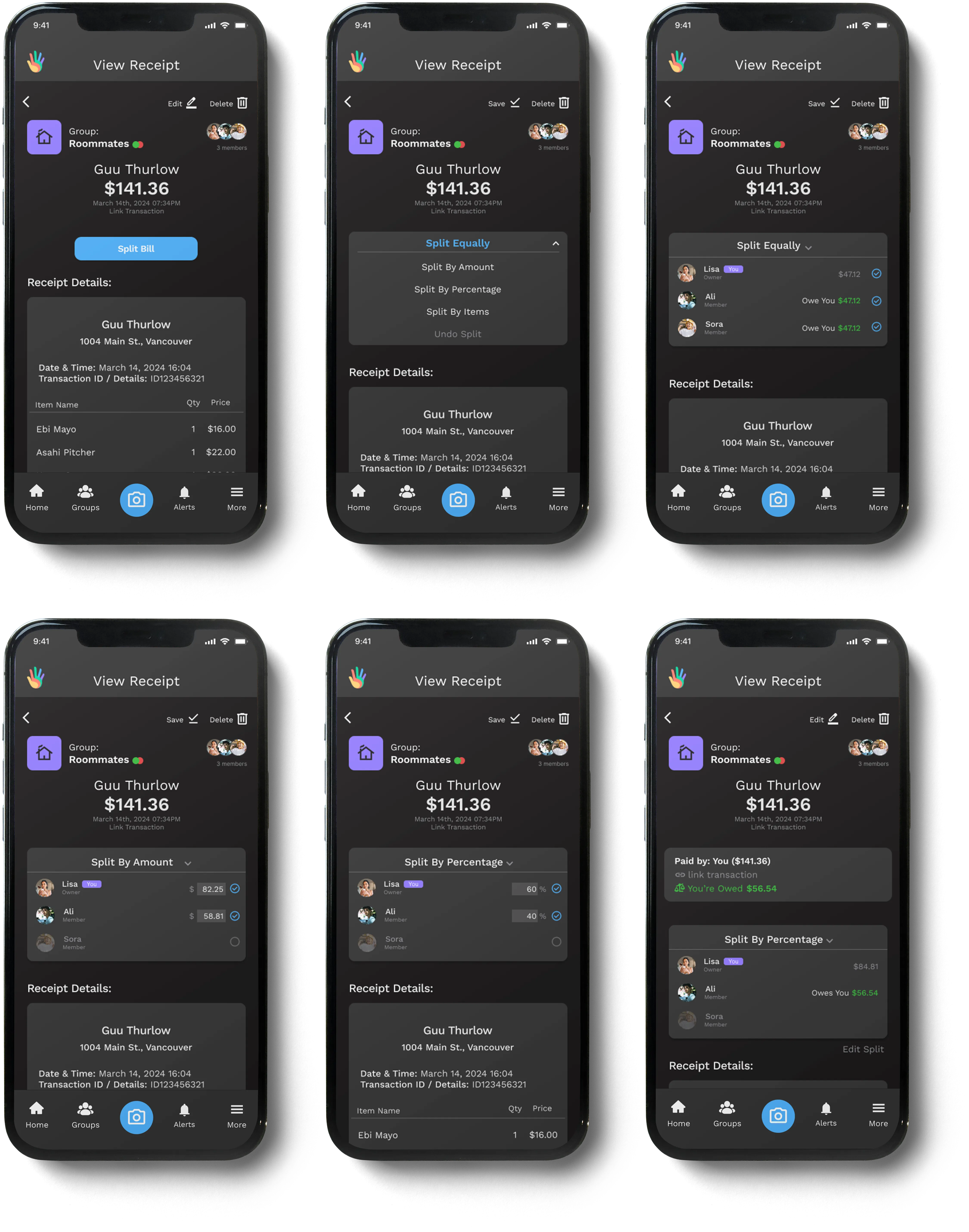

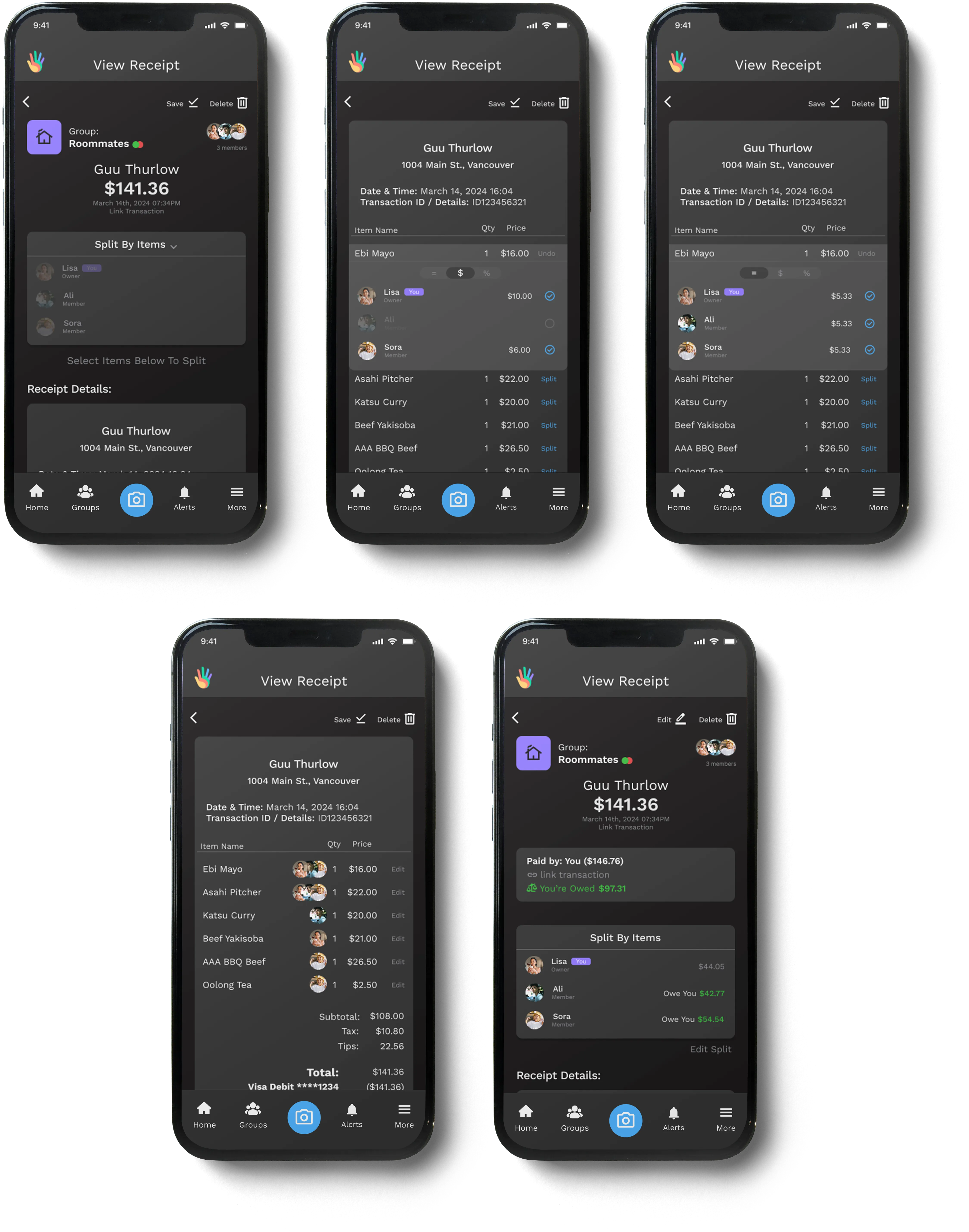

Fairshare is a mobile app designed to simplify shared expense management for young adults by enabling seamless bill splitting, expense tracking, and receipt scanning.

Fairshare was initially created as part of an interdisciplinary project at BCIT, bringing together four designers and three developers from the Digital Design & Development and Full Stack Web Development programs. Over time, it evolved into a passion project, now maintained by two designers and three developers who continue to refine and expand its features whenever time allows.